Pick a personal bank loan matched up to you

Even though they voice similar, secured finance and you may identity money will vary. Automobile name finance use your automobile since the guarantee towards the quick-label funds having ultra-high rates with no credit score assessment demands. Secured loans normally have lengthened loan conditions, down pricing and you will rely partly on your borrowing from the bank and you will earnings getting financing recognition.

In this post:

- What is a guaranteed Loan?

- What’s a subject Loan?

- Name Loan against. Covered Loan

- Choosing Between a secured Unsecured loan and you can a subject Financing

A tiny security may go a considerable ways to your assisting you qualify for a loan otherwise secure a much better rate of interest, particularly when your credit score is below stellar. A few alternatives when you need bucks and want to play with security is actually title fund and you may secured loans.

On the surface, these choices may sound comparable, but you can find extremely important differences between name funds and you may safeguarded individual financing that you should understand before you can obtain. Here’s an easy breakdown with the secured finance in place of label loans.

What is a secured Mortgage?

A guaranteed loan uses your home as guarantee. For folks who default into a guaranteed financing, you can even forfeit new security you pledged therefore, the lender can be sell it and make use of new proceeds to repay your loanmon samples of secured personal loans is actually mortgages, domestic equity finance and you will auto loans.

Secured personal loans

Unsecured loans can certainly be safeguarded of the guarantee. A personal loan enables you to use a lump sum and you will repay it which have need for repaired monthly premiums. A guaranteed unsecured loan may help you be eligible for that loan your otherwise wouldn’t be approved to possess otherwise get a lower life expectancy attract price. This is particularly true whether your credit score is on this new budget of the range.

Really unsecured loans is actually unsecured, many finance companies, credit unions or any other lenders may offer secured loans you to definitely use your assets due to the fact equity. Check out samples of (and you can variations for the) secured personal loans:

- Share-secured personal loans: Also called since passbook money, this type of funds make use of your checking account (and additionally Dvds or money areas) to help you secure a consumer loan. Share-secured finance appear of banking institutions, borrowing unions and several on the web loan providers.

- Securities-backed credit: For those who have generous financial support assets, you happen to be able to accessibility a ties-recognized line of credit from your own lender or brokerage.

- 401(k) loan: Although this plan differs from a normal secure consumer loan, a good 401(k) loan enables you to borrow money from your boss-created old-age deals.

- Dollars value life insurance policies: You are able to borrow against the cash worth of a life otherwise common life insurance policy.

This new equity you can make use of to help you secure financing is typically a top-prevent individual investment, including collectibles, collectibles, precious metals, ways otherwise jewelry.

What’s a title Mortgage?

A name loan usually uses your car and other car given that equity so you can safer an initial-name, high-desire loan. Vehicle title funds are geared towards people that might have complications passageway a credit assessment. Depending on the Government Change Percentage, car label funds express prominent features which can be strange in old-fashioned lending:

- Funds have quite brief terminology, usually coming owed when you look at the 15 so you’re able to thirty days.

A primary-label, small-money financing may cost you three hundred% into the annualized costs. If you have issues affording the loan payments, a concept mortgage can simply ask you for your car too, particularly when you may be borrowing money because your profit try rigid. A survey by Consumer Fund Safety Agency discovered that step 1 in the 5 auto name loan borrowers had the vehicles repossessed.

Name Mortgage against. Secure Financing

No matter if they sound equivalent and you can each other want guarantee, title fund and you will secured loans go after different paths. Generally speaking, check out trick differences to look for between regular secured fund and you can title money:

How to choose Ranging from a guaranteed Personal bank loan and you may a title Mortgage

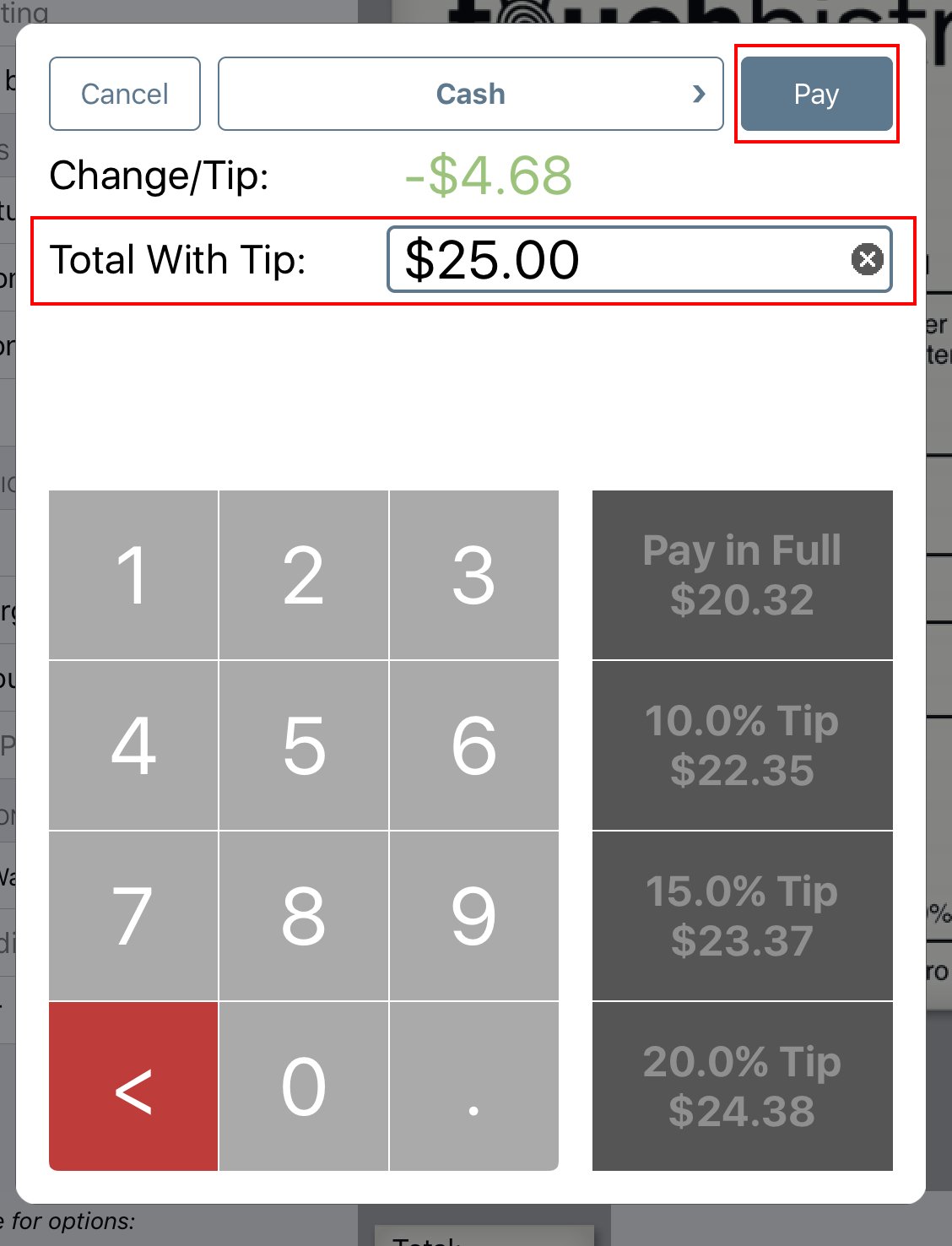

A guaranteed unsecured loan of a lender, credit partnership or on the internet bank also offers many perks more a typical vehicle identity loan, and dramatically reduced interest levels and much more practical cost terms. If you’d like to uncover what the options try, consult your financial or credit partnership, or contemplate using an online opportunities like Experian’s assessment equipment so you’re able to get a hold of secured finance one to suit your credit rating.

No matter where you choose to apply for financing, make sure you remark the loan files meticulously: Lenders are required to explain your loan’s Apr and you will https://clickcashadvance.com/payday-loans-in/ complete will set you back. Watch this new records they provide and, whenever possible, compare several choices to assist make certain you are getting an educated bargain. Likewise, make sure to know very well what goes wrong with their security for folks who cannot make your repayments.

The bottom line

Using your property as the guarantee can help you reduce your financing will set you back otherwise change your possibility of getting recognized to your mortgage you prefer. Secured finance possess experts more than term fund, as well as lower interest rates, extended loan terminology and you will fewer fine print particularly vehicles-renewals which can homes you next in financial trouble or on better exposure having repossession. You should use devices from Experian to find secure personal financing selection centered on your credit score.

Meanwhile, one of the best reasons why you should generate and continue maintaining a good credit score is always to allow yourself choices if you want that loan. Whether you would like financing today otherwise are planning on one out of the future, checking your credit rating and credit history is a wonderful set first off. You’re getting a far greater deal with on which particular finance and you can prices are around for your, and then have suggestions about increasing your credit score so you can improve your attitude through the years.