how to get a cash advance from a bank

Household and you can Property Package Financing Advice for Quick Acceptance

Brisbane residents, John and you can Chloe inquire

My girlfriend and that i are looking at various household and you will home plan money. What type of information would you give us to ensure we result in the best choice and make certain we’re qualified and get acknowledged rapidly?

We perform many domestic and property plan fund for our very own customers here at Financial Globe Australia, so this is an effective matter and another we are able to yes shed some white toward.

You can purchase it which have one or two contracts, an area deal and you may a construction bargain. So, you will be generally purchasing vacant land immediately after which choosing a creator so you can create your a property.

Alternatively, you should buy whats called an effective turnkey plan, or an excellent turnkey domestic. This is when the fresh new builder takes control of all things. Off structure of the home by itself, right through to landscape, fences, as well as the fresh page box.

Household and you may home package sort of finance can be common because of the increase from casing, particularly in portion such Kellyville, Rouse Slope within this Sydney’s North-west. Following however Oran Park, Harrington Playground, Gregory Mountains and you can Harrington Grove once more from the South-west away from Sydney, where there clearly was many new subdivisions appearing all over one urban area.

The problem is additionally comparable into the northern edge of Brisbane in which there is many the fresh new Delphin locations eg North Ponds and Mango Slope. Other places you’ll become Springfield Lakes, Augustine Heights, and you can Brookwater.

Understanding household and you can home bundle financing

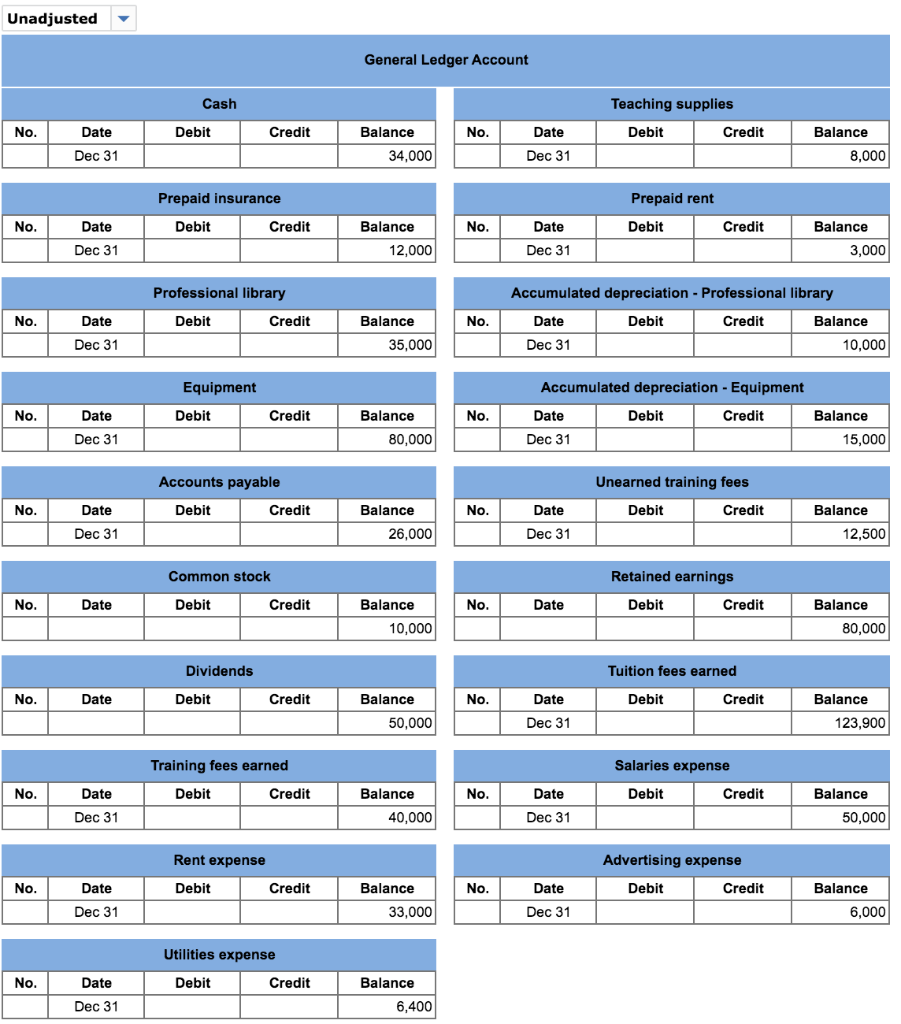

When you’re trying to buy the property earliest, and build later on, you will find loan providers that lend as much as 95% of price, or perhaps the valuation of one’s land itself.

On top of that, when you’re in search of financing to have a complete domestic (home and you may residential property combined) you’ll find lenders that can give around 95% of features value. You’ll be able to use 100% if you have a good guarantor.

It must be indexed you to for these trying to buy the land first, and commence construction of the home afterwards, you can borrow on what is actually described as the as erected valuation. In other words this new towards achievement valuation of the home. This is certainly useful, since if you purchase the latest residential property, and start building 12 months later on, the value of the residential property possess improved in this day, which can reduce the quantity of deposit expected to start building our home. This is influenced by the fresh new valuer when evaluating this new estimated property value our house in complete condition.

Extremely common for many the newest casing estates to put construction day frames to ensure that you make within a particular period of energy when you simply take control of your own homes. You’ll find constantly together with covenants, and that place restrictions in the generate times, styles or any other features the home have to were.

Qualification having a home and you will belongings package loan

Lenders will look at your coupons, plus earnings to ensure that you have enough money to help you solution the borrowed funds. Discover though payday loans Oklahoma some distinctions you to borrowers should be mindful off.

To invest in a completed family

When you are to shop for a house away from a creator, which is, brand new creator possess the home while in the design, you’ll be able to typically shell out an excellent 10% put on signing the brand new offer. After that not cash is paid before the residence is complete and you may settlement happens, at which big date you have to pay the remaining 90%.

To buy belongings first, next strengthening

1st possible borrow enough to accept the latest belongings, up coming immediately following design begins on the household, it is possible to afford the creator into the what is actually called progress payments. Generally speaking, there clearly was five otherwise six advances money generated out over this new builder during structure. Such payments is taken off gradually from your own home financing while in the the building.