Put value to your residence with your equity

What’s the difference in a traditional HELOC and you may an ADU HELOC?

Which have a timeless HELOC, discover a max count in your case to help you acquire – this new line of credit, which can be used for up to ten years. Home owners usually make use of the HELOC having immediate must spend out of higher-attention obligations, scientific costs or do it yourself plans. Additionally, it may act as a safety net throughout the problems. Obtaining the range offered at any time offers safeguards, spirits and you will flexibility. That have an ADU HELOC, the term is a lot faster that have a two-year mark, accompanied by a great 20-year payment months. New line is only able to be taken to have framework purposes for example a property restoration, renovate or addition (ADU). If you need assist distinguishing which kind of HELOC excellent to you personally, get in touch with a mortgage Representative.

How to know how far I’m able to use?

Usually, we can give financial support for up to 125% of your house’s newest worth which includes very first financial (or no) and your the ADU HELOC. Such as, whether your home is really worth $800,000 and you also owe $600,000 on your own first-mortgage, you will be entitled to an enthusiastic ADU HELOC around $eight hundred,000. ($800,000 x 125% = $step one,000,000. $step 1,000,000 $600,000 = $400,000.) Recall, which depends on a number of other things just like your loan recognition, credit history and money. We advice hooking up that have one of our Financial Professionals who specializes in home improvements and you may ADUs.

Sure. You will find closing costs one variety according to the loan matter, plus a lender commission out-of $250. We will together with lover with a houses government seller so there would-be costs paid in it on closing. There is a monthly fee off $50 to have outlines up to $100,000 or $100 for contours greater than 100,000, which is billed before enterprise is done. We are able to help you imagine the closing costs.

What exactly is a keen ADU?

ADUs were known by many labels: grandma flats, yard cottages, in-law equipment, additional units and. An enthusiastic ADU (attachment dwelling equipment) features its own home, bed room and you will bathroom institution. It can either be affixed or isolated about number one household. ADUs are meant to be an accessories to the main domestic consequently they are quicker sizes (and might keeps certain proportions limits set by for each city) and discover behind or even to the medial side of the number one household.

May i create an ADU to my possessions?

For individuals who very own property during the Ca, you are allowed to generate one ADU otherwise Junior ADU (five hundred square feet max and you will attached to the primary quarters) in case your household drops contained in this a residential otherwise combined-explore region. In addition, to support the fresh casing lack, ADU rules provides alleviated over the years and lots of metropolises have sleek the ways to enable it to be easier and affordable. If you’re considering strengthening an ADU and require money https://cashadvanceamerica.net/payday-loans-ok/, speak with one of the Financial Professionals observe exactly what form of loan is good for you.

Do you know the advantages to building a keen ADU?

There are many different! ADUs not one of them most home, are usually extremely rates-energetic, give couch potato leasing earnings while increasing the overall property value your domestic. Nevertheless they give residents the flexibility to express separate living elements having relatives, of the helping aging moms and dads stand nearby as they require way more care and attention, or promote a private place having adult people to live on and you will lease.

Is the financing techniques longer than a traditional HELOC?

Yes the entire capital procedure to own a keen ADU HELOC will require far more day than a timeless HELOC. This is due primarily to the fresh state-of-the-art characteristics and you may documents needed to own framework, building it allows, monitors and. It’s best to possess a conversation which have our House Loan Professionals regarding your opportunity basic. They are able to make it easier to know if an enthusiastic ADU HELOC is right for your requirements and certainly will next refer that one of the framework administration lovers to help you go ahead which have a loan application. For every endeavor is unique and our company is here to simply help

Our house Mortgage Specialists is specialized in ADU and you will household renovation investment and can make it easier to know if an ADU HELOC was right for you. Find one close by otherwise label x1202 for connecting.

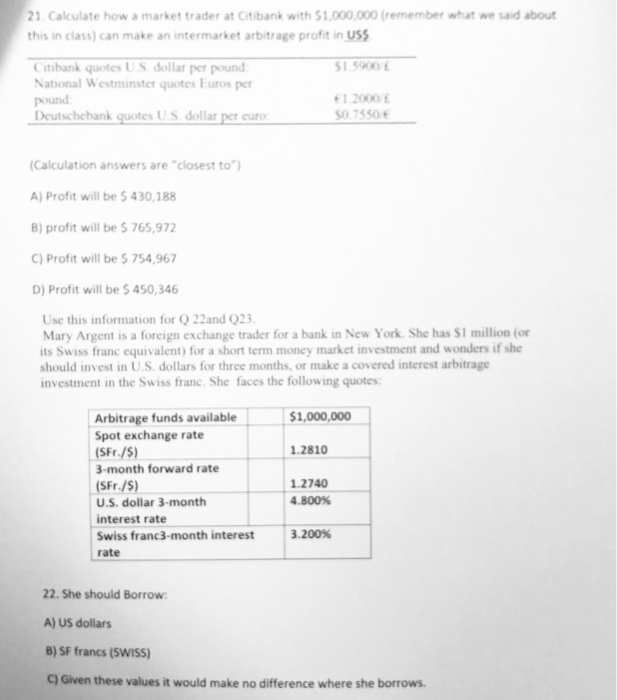

step 1 Household Equity finance and you may personal lines of credit are available into the California attributes simply. nine.50% Apr (apr) or any other terms found is specific by and implement so you can an ADU HELOC for the most certified candidate at CLTV right up to help you 125%. Not all applicants often be eligible for a low price. Eligible toward top homes only. Rates are very different based on property value, credit score, range number and other items. Minimal occasional payment is actually desire-simply for the original 2 yrs (draw period) with fully-amortizing costs to settle the bill across the final two decades. Zero draws could be greeting inside the installment several months. Repayments and you will speed is also to change month-to-month. Repayments increase in the event that pricing raise. At the end of brand new draw period, your own called for monthly payments increase because you will getting purchasing both principal and you can focus. The interest rate was determined having fun with a list also a margin. This new directory used ‘s the Prime Price since the wrote regarding the Wall surface Roadway Diary West Version for the history working day regarding the newest month prior to the changes. The current best directory was 8.0. Minimal interest rate are step 3.5%. Limitation interest was 17%.