payday loans with no bank account or credit check

cuatro. Build a deal and get complete approval

There are even other options available to you, for example focus-just home loans and line of credit mortgage brokers. not, whenever you are an initial house customer, talking about possibly the three selection you’re going to be putting right up between.

Getting home financing

Desire check out videos? Find out how Rateseeker makes it possible to secure the sharpest home loan speed inside explainer movies.

step one. online personal loans MI Save yourself getting in initial deposit

Basic some thing basic: before getting home financing, you should have a deposit, which is a portion of your complete purchase price you are thinking about offering. For the majority Aussies, the entire guideline is always to rescue in initial deposit off as much as 20%, if you’d like to end investing lenders financial insurance policies.

As you can be commercially become approved getting a mortgage which have only 5%, lenders you are going to see you due to the fact riskier that can has extra limitations and come up with your application harder to be acknowledged such as for example exhibiting you to definitely you may have legitimate discounts -even after investing Loan providers Home loan Insurance (LMI). The reason being the loan insurance company (Genworth or QBE) will also have so you can accept your house loan application.

dos. Browse more mortgage rates

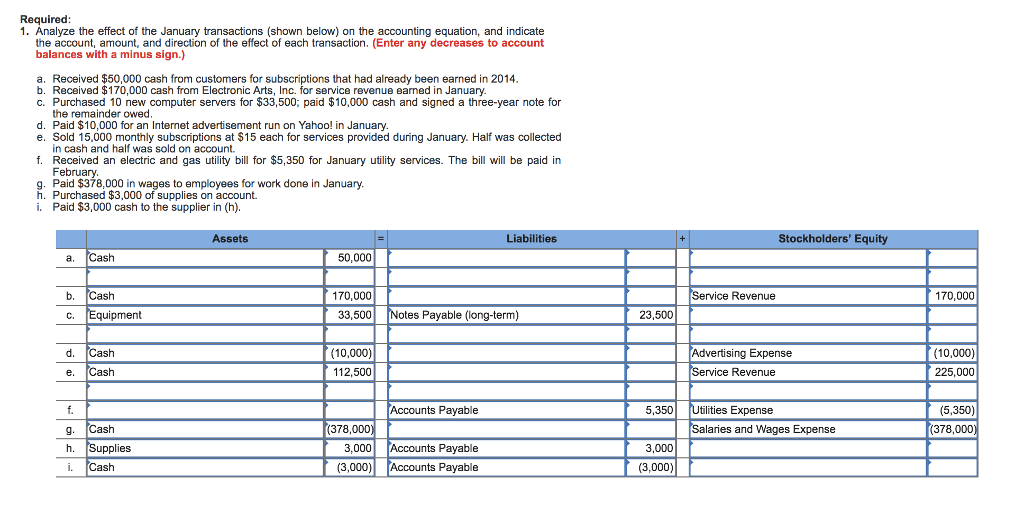

Even as we stated prior to, actually an obviously unimportant count on the financial interest rate accumulates through the years.

Example: Let’s say you really have home financing away from $300,000 more than a twenty five-year loan identity. Let me reveal a look at how your repayments perform sound right more than time:

Specialist idea: While it is simple to visit your own nearby lender, just remember that , they will not also have brand new sharpest focus cost around. The ultimate way to browse all of the different financial rates is by using a home loan rates comparison system like Rateseeker. By doing this, you could potentially contrast some other rates out of over 30+ loan providers and get one which gives you an educated offer on your financing.

3. Safe pre-recognition

After you have a concept of the house loan you might be immediately after, the next step is to get pre-accepted for the loan. So it part is not compulsory and never all the loan providers offer they. Although not, whenever you can score pre-approval, it gets you to invest in able and gives the trust and come up with an offer to the a property.

Pre-recognition will provide you with a rough idea of simply how much you might borrow, centered on the deposit, credit history and lots of financial pointers. it strengthens your own bargaining electricity when you find yourself while making a deal to your a home. When your vendor understands that you happen to be pre-recognized, you’ll be recognized as a popular visitors – which comes in helpful if you have intense race to possess a property.

Enough loan providers (including the major banks) allows you to complete the pre-approval process on the web. The complete techniques you can certainly do in a matter of occasions if not a short time. However, be aware that you may still need to visit a great branch having an in-individual visit.

Now that you is actually buying ready’ and found forget the otherwise permanently home’, you will have to rating unconditional recognition from the lender to maneuver send.

After you have generated an offer, the financial will demand you to definitely offer an agreement off marketing. They’ll following carry out good valuation of the house and you will, in the event the recognized, draft the loan data files. Should this be all all set, you will get the loan documents and you may bargain. Such should be analyzed by your solicitor otherwise conveyancer, following signed by the both you and the seller.

six. Organizing payment

This is actually the latest a portion of the home loan procedure: settlement. This is where the seller technically transmits the house for your requirements, therefore get the latest keys to your brand new domestic. Also, it is in the event the mortgage kicks towards impact, and you are clearly expected to finalise and you may purchase the related costs that accompanies to acquire a home (eg stamp responsibility).