What’s the FHA Mortgage Restrict inside the Ohio?

FHA financing assist basic-go out homebuyers and the ones with challenged borrowing get to their property to order goals after they or even might not qualify for a traditional financial. Backed by the government, FHA loans from inside the Ohio through Griffin Investment render aggressive interest rates, low-down money, and flexible credit conditions.

What is an enthusiastic FHA Financing?

An enthusiastic FHA financing is a kind of mortgage that is insured from the All of us regulators into intention of getting accessible investment to families that would if not perhaps not be eligible for an effective traditional Kansas mortgage . Mainly because money is actually backed by the latest Federal Housing Government (FHA), brand new economic chance to help you lenders is significantly reduced.

So it smaller chance lets an enthusiastic FHA bank inside Ohio, particularly Griffin Funding, to offer financing in order to basic-big date home buyers otherwise those with reduced-than-primary credit history, while maintaining low down commission requirements, flexible credit qualifying requirements, and aggressive costs.

Great things about Kansas FHA Finance

Here are just a few of the many benefits of making use of a keen FHA home loan inside the Kansas to find or refurbish a beneficial home:

- Competitive rates: As the FHA assumes a number of the financial exposure, lenders could offer payday loan Remlap Alabama competitive interest rates you to definitely competition old-fashioned mortgage loans.

- Versatile borrowing from the bank conditions: A relatively lower FICO score, limited borrowing from the bank record, otherwise earlier personal bankruptcy doesn’t quickly disqualify you against an enthusiastic FHA financing in the Kansas. For as long as the application suggests in control financial habits, earnings texture, and you will a credit history with a minimum of five-hundred, you could nevertheless be eligible.

- Low-down fee conditions: The brand new down-payment having an ohio FHA loan can be as reduced due to the fact 3.5% to own a well-qualified debtor. It is less than plain old 5% so you can 20% requirement for traditional mortgage loans.

- Versatile framework: The FHA 203(k) program offers the opportunity to swelling your property buy additionally the price of one expected renovations otherwise fixes into just one home loan. There are also choices for repaired- otherwise varying-rate mortgages.

FHA Loan Requirements in Kansas

Kansas FHA loan conditions tend to be far more versatile than the conventional mortgage loans. not, there are basic standards you’ll need to fulfill:

- Credit score: Essentially, your credit score should be at the least 580 getting sensed toward all the way down step three.5% deposit criteria. A great FICO only 500 are still experienced to have acceptance, but not a much bigger advance payment as much as ten% may be required.

- Down payment: At least step 3.5% advance payment is needed to possess Kansas FHA loans.

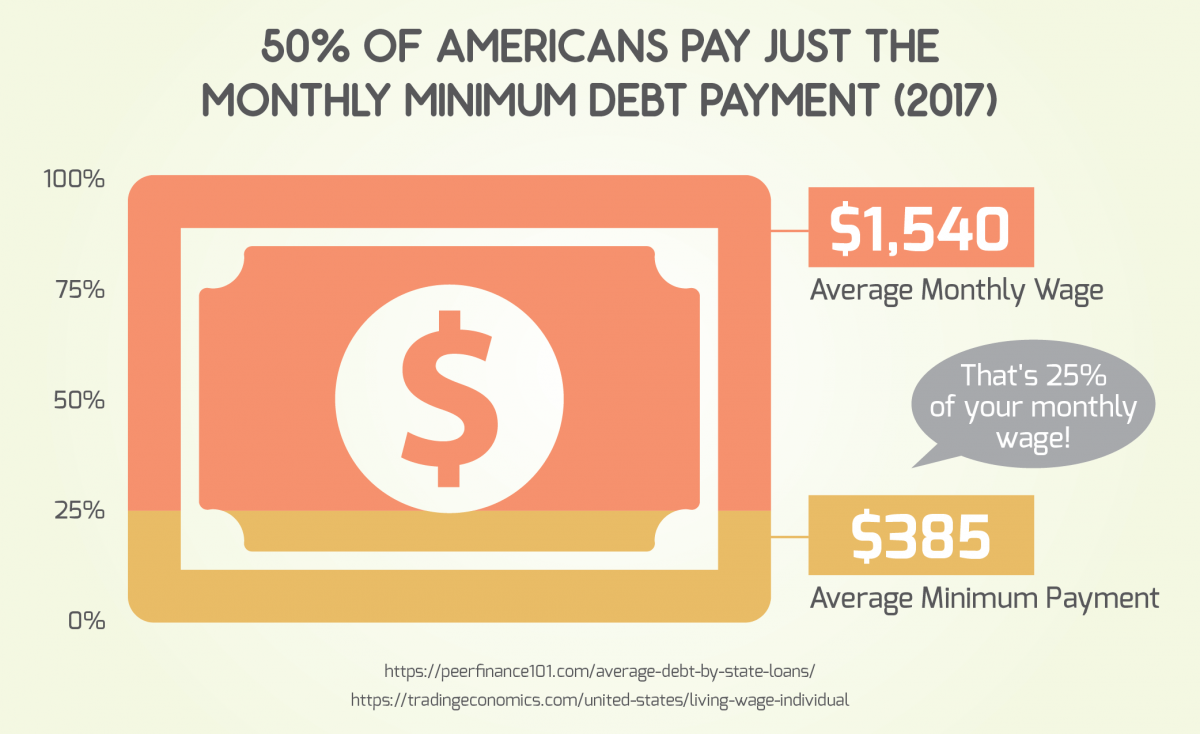

- Debt-to-money ratio (DTI): That it count is a straightforward computation of the disgusting monthly income, before taxation, you to goes toward paying off bills and costs. Having an ohio FHA financing, a good DTI as high as 57% will be believed. But not, remember that a diminished DTI helps you qualify having a lower life expectancy price and better terms.

- Regular work and you can money: Proof couple of years regarding uniform work record required. There’s absolutely no minimum number of money from this work; structure is exactly what loan providers require.

- Possessions conditions: While you are home browse , you’ll want to understand the respective county’s FHA loan limitation and you will keep in mind the challenge requirements place of the FHA so you’re able to make sure the residence is safe, sound, and structurally secure.

I encourage downloading the Griffin Silver app observe your own borrowing, score suggestions to improve your credit score, tune your money and you can costs, and construct a plan so you can safe a keen FHA mortgage approval for the fantasy family.

From inside the Kansas, the latest FHA mortgage maximum statewide is currently $498,257 getting one-home. Therefore regardless if you are applying for an enthusiastic FHA mortgage when you look at the sprawling Ohio Area otherwise pleasant Abilene, brand new limitation is similar.

These types of FHA loan limitations are prepared of the HUD, and are also in line with the average home prices in each book condition otherwise populace urban area, therefore, the limits is actually subject to lso are-review over the years because the home values go up and you can slide. You need buy a property you to definitely exceeds your local FHA financing limitation, but you’ll need protection the essential difference between the loan restriction as well as the price with a down-payment.

Ways to get a keen FHA Home loan from inside the Kansas

Given that Griffin Capital specializes in Kansas FHA money, there is made the program techniques since the simple as you can easily. Here are the simple steps:

Mate Having a respected FHA Financial inside Ohio

If you’ve got challenge securing a mortgage recognition because of restricted credit score, early in the day financial hardships, and/or decreased a sizable downpayment, an FHA mortgage inside the Ohio may be a fantastic choice particularly if you happen to be a primary-big date household client or are merely out-of-school.

Traditional bank loans greatly prefer reasonable-risk borrowers with reasonable obligations, large income, and enormous off repayments; this makes a significant amount of the people instead financing to pick property. FHA funds offer opportunities for lots more individuals to see their fantasy regarding homeownership, every and offers really competitive rates of interest, low-down percentage requirements, and versatile credit requirements.

Don’t assume all lender focuses on Ohio FHA financing. Apply now having Griffin Financing to see exactly what dealing with a keen experienced FHA lender during the Ohio does to produce your imagine homeownership a real possibility. All of our dedicated team from mortgage officers are position by the to resolve the questions you have that assist the thing is that the best financial support selection for your needs.