KBHS Mortgage brokers Is the Within the-House Lending company to possess KB Belongings

Since the identity ways, they are affiliated financial to own family builder KB Household, a SoCal-situated business that has been doing because the 1950s.

KB House enjoys a giant home building visibility within its family state, as well as regional Arizona and Las vegas, nevada, Texas, and Florida.

What’s perhaps a lot more interesting is that they is actually supported by a different lender, Protected Price, which is a premier-10 lender nationwide.

- In-home mortgage lender to possess parent business KB Residential property

- Created into the 1957, headquartered in La, Ca

- Moms and dad company is publicly exchanged (NYSE: KBH)

- Registered so you can give during the ten claims across the country

- Financed nearly $3.5 mil in home finance this past year

- Really energetic Spring Garden loans when you look at the California, Fl, and you will Colorado

- Supply an affiliated insurance agency and identity organization

The Southern area Ca founded household creator has been around since 1957, having in past times been titled just after creators Eli Wide and you can Donald Kaufman as the Kaufman and you will Wide Strengthening Team.

One of its claims to fame is the creation of the new Townehouse construction, intended to woo customers who does typically book rather than get a house.

The company afterwards altered the label to help you KB House within the 2001 and after this means itself because the #step one buyers-ranked federal homebuilder.

That’s predicated on TrustBuilder analysis and you may product reviews that are powered by NewHomeSource, an internet site one to seem to lists sincere evaluations of genuine people.

Anyhow, KB House mainly based a unique mortgage lender back in 1965, and that sooner morphed towards what is actually today KBHS Lenders.

He is licensed in ten says across the country, along with Arizona, Ca, Texas, Florida, Idaho, Vermont, Vegas, Sc, Texas, and you will Washington.

Last year, the organization financed a stronger $step three.5 mil home based loans, with a good amount of it via their residence state out-of Ca.

KBHS Home loans prides in itself into getting a fully-provided, loyal lending company getting KB House, that have daily venture to ensure anything excersice along with the schedule.

Like many family designers, they likewise have an affiliated insurer, KB Home insurance Agencies, and title insurance rates company, KB Household Label Functions.

Tips Pertain which have KBHS Home loans

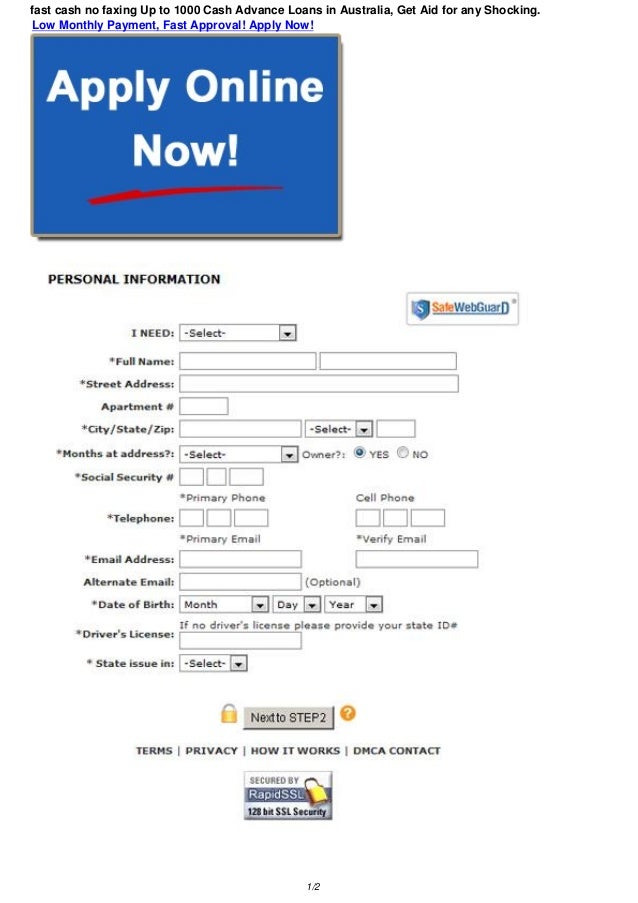

To begin, you can either go to a new domestic society otherwise search towards the off to brand new KBHS Lenders site.

If you do the second, they have an internet mortgage manager list and you may a contact page if you prefer for somebody to reach away really.

There is also a training cardiovascular system having a mortgage glossary, totally free mortgage calculator, academic videos and posts, and you may an effective FAQ part.

When you’re ready to utilize, you can do thus electronically thru the digital application for the loan out-of a pc, tablet, otherwise mobile.

Permits one finish the processes generally paperlessly, it is able to link monetary accounts (bank, workplace, etc.) and you can properly publish papers.

Once your financing are recorded, you’ll log in to the latest debtor portal 24/seven to test financing updates, see the criteria, or get in touch with your own lending class.

KBHS Mortgage brokers financing officials also provide the capacity to screen share within the real-time if you’d like most help you complete any step from the borrowed funds process.

When it comes time to cover, the very-entitled FlashClose techniques allows consumers to signal a majority of their closure files electronically.

It means you could digitally comment and you may show records ahead together with your attorneys otherwise settlement broker and spend less day within the newest closing table.

Loan Applications Supplied by KBHS

- Family buy funds

- Compliant money

KBHS Home loans even offers all of the usual factors you expect so you’re able to pick off a home loan company, even in the event it mainly run household pick finance.

This consists of conforming loans, jumbo financing, and the complete package off bodies-supported funds plus FHA financing, Virtual assistant funds, and USDA financing.

When you consider home loan pricing will come straight back in the near future within next 5-7 decades, a hybrid Case like the 5/6 Arm or 7/six Arm might possibly be good link.

KBHS Financial Prices and you will Lender Fees

We did not come across people details about their site out-of home loan costs or lender charges. Nonetheless performed features an alternative rate giving towards the KB House website.

It was a great 7/six Sleeve priced on the a couple of payment activities beneath the supposed speed to own a 30-year fixed. Thus for these prepared to squeeze into an arm, it gifts a pretty larger disregard.

And it is fixed with the earliest 84 months, giving the home buyer some respiration place before they should thought a beneficial re-finance, household selling, an such like.

Generally, household builders render mortgage rates buydowns, such as for example a 2-step 1 buydown, however, maybe those individuals are receiving too costly and there’s a change so you can Fingers going on.

It’s not sure what the fixed mortgage pricing are just like therefore you’ll need require prices once you speak to that loan administrator.

It’s best that you come across what is around and you may gain specific negotiating electricity in the process. That you don’t have to seem like you don’t need other options

KBHS Home loans Ratings

KBHS Home loans has actually a great 4.9/5-star rating regarding more than step three,000 Bing critiques, which is unbelievable to the the remark amount therefore the get.

There is a large number of shining analysis off new home buyers, and in addition specific terrible recommendations also. You might filter out by the large and reasonable score observe what other’s experiences was indeed.

Over at the better Company Agency (BBB) webpages, he has a keen A+’ get according to ailment background, however, a-1.08/5 rating based on the 84 buyers reviews indeed there.

There is also more 300 complaints over the past 3 years, also over 170 for the past one year.

This really is one of the demands out-of powering a house builder division and you can home financing credit division. It’s difficult to make somebody delighted in one of men and women traces away from organization.

But if everything you happens according to plan, these include able to provide special incentives you may not look for with other loan providers or established family vendors.

The largest cheer to presenting property builder’s bank during the moment ‘s the potential for a bought down rate.

Tend to, designers deliver large rates offers to help you get into a brand new home, or promote closure prices loans, otherwise one another.

As process could be more streamlined having an affiliated bank/creator, don’t compromise rates in the process. Whatsoever, the borrowed funds you’ll stick with you plenty more than the latest