Any time you Pay off Credit card debt Prior to purchasing property?

More often than not, it seems sensible to pay off credit card debt before you buy a property. Repaying credit debt can increase your credit rating and you can decrease your debt-to-earnings ratio, both of that may meet the requirements your for all the way down mortgage rates.

In this article:

- The thing that makes Credit debt something When purchasing property?

- Whenever Is Paying down Personal credit card debt best?

- Whenever Could it possibly be Okay to leave The Personal credit card debt Alone?

- The conclusion

If you’d like to purchase a property, holding credit card debt does not have any to save you against rewarding your perfect. However, repaying the debt will reduce your personal debt-to-earnings ratio (DTI) and could improve your credit rating. One, subsequently, allows you to be eligible for a mortgage and possibly score your a lower rate of interest.

The choice out-of whether or loans Riverton CT not to reduce credit card debt prior to to purchase a house depends on of many affairs, particularly how much debt you really have, your revenue and your offered savings. You can find advice, however, that will help point your on best direction. Here’s what to learn about credit debt and you can homeownership.

Why is Credit card debt a very important factor When purchasing a home?

Merely which have credit debt most likely won’t disqualify you from to find property. But it ple, in how mortgage brokers see you because the a possible debtor. Here’s how:

- Credit debt develops your own DTI. One of the most key elements of your own mortgage software is their DTI, as well as your estimated month-to-month mortgage repayment. The more your credit debt, more the DTI, therefore the higher the possibility the home loan application can be declined.

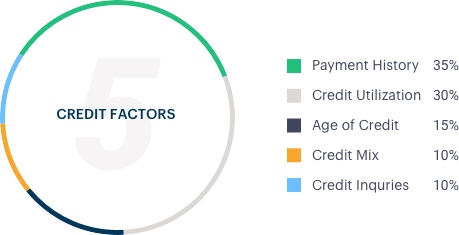

- Personal credit card debt influences your credit score. Loan providers watch your credit score as well as the details on the credit history, as well as during the kind of obligations you borrowed in addition to their balance. Settling credit debt reduces your own wide variety due, that’s a major reason behind your credit rating.

- Credit card debt limits the mortgage payment you can afford. While to make a substantial charge card percentage every month, trying out a home loan could well be a-strain. Not only will lenders keep this in mind when evaluating their application, however your funds would be overburdened.

Whenever Is actually Settling Personal credit card debt wise?

Usually, paying down charge card stability-otherwise paying doing you could potentially to bring the balances down-is the proper disperse. You are able to lower your DTI and, develop, raise your credit score and you will be eligible for a lesser rate of interest on the financial.

Here is how it functions: The degree of credit card debt you bring in accordance with your own credit limit (round the all the cards you really have, and for each person credit) makes up about your credit application speed. This is the second the very first thing on your FICO Rating ? . Mortgage brokers are probably to make use of the FICO Score dos, four to five activities to check on the application, but a reduced borrowing from the bank utilization speed tends to benefit you for everybody models of your own FICO Score. Seek to continue your personal lower than 30% constantly; the lower, the higher.

Removing credit debt might create a massive impact on DTI. Find their DTI with the addition of to one another all your valuable current month-to-month obligations loans, together with your likely mortgage repayment, and you will separating they by the month-to-month pre-income tax earnings. An appropriate DTI-that’ll allow you to get accessibility one particular good home loan words-is thirty-six% otherwise less. Certain kinds of mortgages keeps quite less limiting DTI conditions, but you is to nevertheless aim to remain your personal below 43%.

Whenever Will it be Ok to leave Your Credit card debt By yourself?

In some situations, it might not end up being totally had a need to pay-off your credit debt before you buy property. Respond to this type of trick issues to determine for people who fall into so it category:

- What exactly is your credit rating? Use a free of charge credit history service, instance Experian’s, to view your current FICO Rating. Although it may not be the exact score you to definitely loan providers often explore (Experian brings your own FICO Rating 8, such, unlike FICO Get dos, 4 or 5), you’ll get a general sense to have where your own get falls. When it is already a great or advanced-believe 700 or higher towards the an 850-section scale-you will possibly not need certainly to prioritize settling playing cards, at the least in order to reinforce their borrowing.

- Have you got independence on your finances? Depending on your revenue along with your latest loans harmony, you may be with ease and then make the credit card repayments (and even lowering your harmony). When you can reduce debt when you’re saving cash each few days to have problems, advancing years and other desires-like your down payment-your own personal credit card debt is likely in check.

- Are you experiencing a propose to pay back the debt? If you’re not gonna get rid of credit card debt today, pick an effective way to repay it within this quite a long time body type. That’s because homeownership means incorporating an abundance of new expenses to your finances: not simply the house loan itself, but possessions taxes, insurance rates, restoration plus. You could potentially safely rating a home loan with some credit debt when you yourself have a concrete bundle set up based on how to bring your charge card stability to help you $0 in this, state, one or two decades.

The bottom line

Settling personal credit card debt is one way to get your self on most powerful condition it is possible to to adopt a home loan. If your credit and you may finances have good profile and you are looking to get a home rapidly, you might not need to work at removing credit card stability. But it’s still imperative to know the way a mortgage usually effect your capability to afford their costs and save your self for future years.

Play with a mortgage calculator discover their potential month-to-month homeloan payment to see just how most other casing expenses tend to apply to your financial budget. Personal credit card debt must not stand-in the way in which of getting the fantasy household, therefore really should not be a continuous responsibility weighing off your allowance, sometimes.