Can i Get a top-Through to My personal Home loan?

Big date Typed:

There are various good reason you are trying eliminate some collateral from the property to utilize somewhere else. This is exactly commonly titled a beneficial top-up’ on your own mortgage.

You have made cash to spend (yay!) however in return the home loan will get big. Attention billed on that dollars ensures that if you do not shell out it straight back rapidly you’re going to be repaying even more money as compared to count you got out. Therefore, before you could inquire whether or not you can aquire a premier-upwards, it is critical to ponder if it’s called for and you may worth the continuous additional cost.

Are a premier-within the best issue for me?

A leading-upwards is often times removed so you’re able to funds maintenance or developments with the possessions in itself. That is a good idea if the functions complete towards the house will keep otherwise boost the property’s well worth. Or, for example, when it commonly replace your quality of life as you live here. Will these products wade hand in hand, instance establishing a hot air pump about lounge otherwise renovating a vintage home often boost both value of and your standard of living.

The object to consider is whether or not you will be making changes one to buyers will likely worthy of when you attend offer. Considering landscaping your garden on the a mini course done having those types of frightening clown mouth area obstacles and a micro eiffel tower? It is going to be expensive and you can going to turn off of several consumers along the track. Actually, one thing involving clowns is going to drastically lower your sector focus.

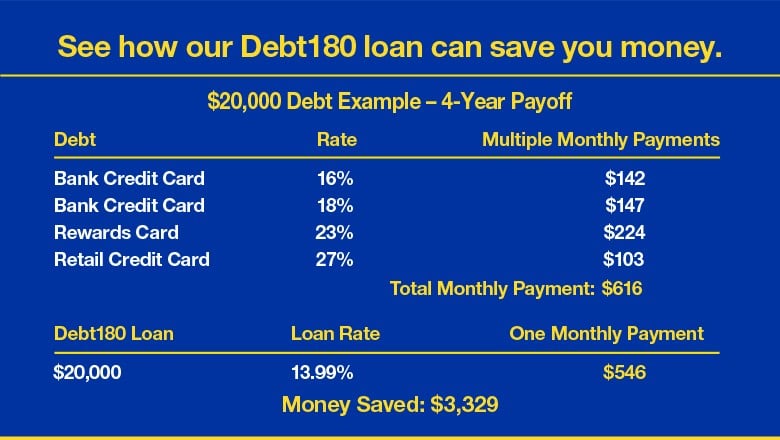

There is an instance whenever a leading-upwards may actually save you money. If you have people personal debt that you are spending highest interest levels with the than simply the mortgage rate of interest, you could potentially spend less combining those people debts into the home loan. not there was split charge from inside the purchasing those highest appeal debts out of smaller than just prepared . Some data should be done to identify be it economically advantageous to simply take it approa ch . Their large financial company makes it possible to work out whether it’s good a great circulate to you personally.

What do banking institutions be the cause of whenever choosing whether to approve a loan application to have a leading-right up?

- Earnings, along with whether it’s secure,

- Expenses habits

- Power to shell out attract at the a higher rate (

- Most other expense, and you may

- Credit history.

Brand new CCCFA features laws and regulations which means that banking institutions are in fact most exposure averse in terms of credit. The lending company North Dakota payday loans can only approve a leading-right up if they’re found as possible solution the elevated mortgage costs. They now want three months of bank comments one confirm the current using models allows the increased mortgage repayments. Might plus determine this new affordability of mortgage top-upwards using an interest rate off

7% into entirety of financial. For this reason some people that once will have their most readily useful-right up software accepted are becoming declined.

The bank are only able to agree a high-up if they are completely found you could service the enhanced financing payments.

On top of that, there should be adequate collateral about assets. A financial commonly hardly ever accept a high-up that will place the assets over the 80% Financing to help you Well worth Ratio (LVR) endurance.

To make them credit responsibly, the bank have a tendency to ask for up-to-time proof money and your finances. This is exactly hard , because you e information at the time of the original financial. But the bank should be in hopes you to their decision was informed by your most recent issues.

Really does the bank care the thing i am with the currency getting?

Sure, so you can a point. The term of your finest-right up is going to be faster compared to the remaining mortgage. The main cause of the loan will assist dictate that point away from the mortgage.

If your money is not going with the a valuable asset, t he bank set reduced symptoms to the greatest-to be paid away from. For example, you can buy a premier-right up having a car loan however, you to debt might be organized is paid back more five years. For the reason that it’s a depreciating resource.

If you are after a secondary otherwise the chairs they will not fundamentally decline your application. B ut a gain, the loan is payable over a smaller title. Believe cautiously prior to getting a leading-up to possess anything that cannot build the value of your own property. If you don’t repay it instantly you are expenses a large amount within the attention. Factor that desire into price of what you’re purchasing just before you decide whether it is worth every penny or perhaps not.

While you are credit the bucks to start another company one to do indicate that your revenue is about to changes . To phrase it differently, we t could be you will end your work. That makes your existing proven income unimportant plus capacity to solution the mortgage have been around in concern. However, if it is to possess a side hustle unlike your main money weight up coming t the guy bank has a tendency to lookup into the it favourably.

The key procedure is to be honest. The financial institution is trying doing correct from you economically . Y ainsi que wouldn’t would your self one favours by giving false information.

How to increase my personal chances of getting my personal most readily useful-right up application approved?

Guess what we will state! Explore a mortgage broker. They ensure that your software is manageable and that you’ve offered people support information the bank will demand. They’ll certainly be capable of giving your a sign of the alternative of one’s software being qualified, and advise of every action you may need to sample build your situation more desirable on the lender.

At the same time, For people who have not had your residence valued recently, get this complete. Chances are your property are certain to get gone up during the well worth, making the LVR ratio much more attractive to financial institutions. For people who have not in the past repaid your mortgage off, that is the answer to getting the better-up acknowledged.

Indeed there you really have it. Top-ups commonly is inserted to your gently but could end up being an excellent good option in a number of affairs. Apply continuous thought to the decision making and you also won’t go awry.

Financial Lab’s goal is usually to be brand new electronic urban area rectangular to have economic choice-companies to increase information about their newest and you can future mortgage. Realize us for the Fb and you may LinkedIn or sign up for the newsletter becoming notified of your newest content.