Providing a personal bank loan On the web which have good 700 Credit history

Life is volatile and all of a sudden you need currency to have crucial such things as treatment, education, otherwise a married relationship. A personal bank loan can help you get the loans need throughout such as issues. not, your CIBIL (credit) get plays a huge role in enabling approved getting a personal financing. You might ponder, exactly how much CIBIL get is perfect for a consumer loan? A get a lot more than 700 can be experienced a and you may makes it simpler to score financing. Though the CIBIL get is about 700, you could potentially however make an application for a consumer loan while a credit card manager. With a few preparation and also by dealing with the borrowing well, you can get a personal bank loan on line as it’s needed.

Do you really rating a personal loan in case your CIBIL get try 700?

This will depend. You ought to work out how much currency you desire. Look at your costs and you can money to understand the best mortgage number. Even after a rating away from 700, that’s not very high, you can however get a personal bank loan. not, some lenders may charge you highest interest rates because your rating is modest. Whenever implementing, usually do not send apps in order to multiple loan providers at a time thinking it does enhance your chance. This may actually harm your credit score then.

Once you have used that have one bank, score any data files able instance pay slips, lender comments an such like. Partial otherwise incorrect data is a familiar reason for loan getting rejected. If you understand your position, choose the best lender, and you can fill in proper records, your stand a high probability of getting you to unsecured loan even after an effective 700 CIBIL rating.

Different methods to Rating an unsecured loan with a 700 Borrowing Rating

A great CIBIL get out of 700 is considered the average credit history. This doesn’t mean you can not rating a consumer loan, but lenders tend to test out your software much more carefully. If you are an effective 700 rating isn’t crappy, additionally will not verify loan recognition. Loan providers may wish to look closer at the complete finances. But not, there are actions you can take to improve your odds of having the unsecured loan you would like, even after a media 700 CIBIL get.

Apply for a fair Amount borrowed

That have good 700 rating, it is possible to seem riskier in order to loan providers therefore cannot ask for also high an amount borrowed that you can’t pay off without difficulty. Consult an amount you actually need and certainly will afford considering your earnings and you may expenses. This indicates duty.

Evaluate and you will Augment Credit history Problems

To purchase your credit file and proceed through it very carefully. In the event the there are people errors for example completely wrong percentage facts, disagreement them with the credit bureau. Also brief mistakes can somewhat drag down your get thus get them fixed.

Reveal Proof of Income

Lenders like to see you earn enough to pay off the borrowed funds. Provide the newest salary slides, financial statements, taxation files an such like. For those who has just got a boost otherwise any additional earnings, high light one to boost the possibility.

Implement which have an excellent Co-Signer

Having someone with a high credit score co-signal the borrowed funds enables you to research much safer. This could be a relative otherwise pal however, they will be just as responsible for fees if you can’t shell out.

Describe People Economic Difficulties

Should you have situations including jobs losings or medical expenses you to triggered missed money and you can affected the rating, identify so it briefly towards lender. They may see the state ideal.

Examine Several Lenders

Additional loan providers look at apps differently. By checking with several lenders, you will be prone to choose one that gives you the best terminology considering your unique profile.

Just how to Replace your 700 Credit history?

Otherwise urgently required, spend some weeks boosting your 700 get before you apply for the financing. A high get will get your most readily useful rates of interest. Below are a few an approach to improve your 700 credit rating:

- Pay-all their costs timely – playing cards, loans, etcetera. Late repayments very harm their score, very definitely spend the money for complete amount owed per month whenever possible.

- Never sign up for too many new credit at once – for every app gets noted and can temporarily lose your score. Apply selectively whenever really expected.

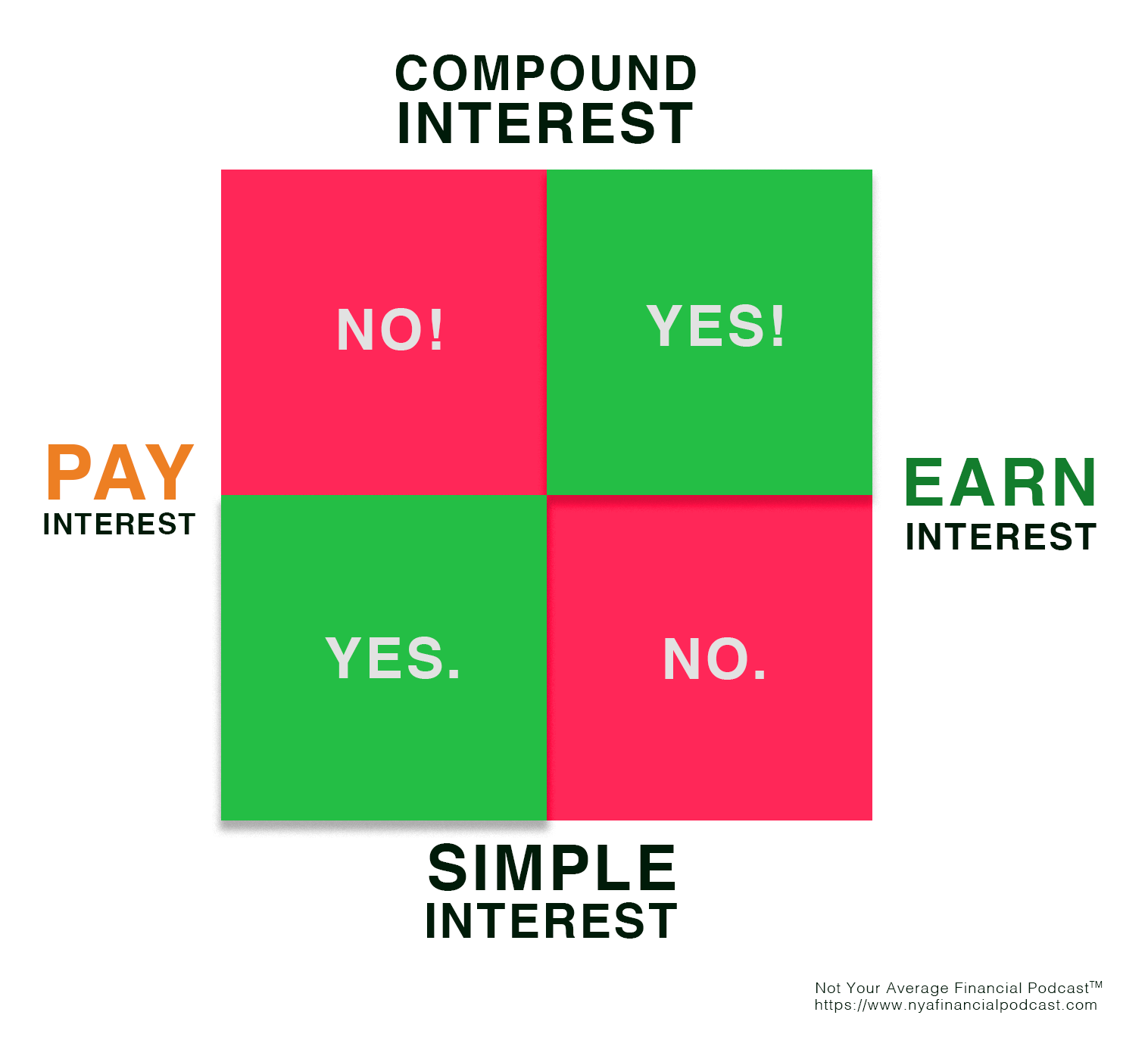

- Enjoys a mixture of different kinds of borrowing from the bank – cards, signature loans https://paydayloanalabama.com/red-bay/, automotive loans an such like. That it range demonstrates to you are designed for various sorts sensibly.

- Keep dated profile unlock regardless of if reduced. An extended credit history assists your rating.

- Look at your credit file frequently having problems while having all of them fixed. One short mistake brings your rating down unfairly.

That have a moderate 700 score, loan providers can charge your high rates of interest since they see you since a while riskier. But with specific smart implies and you may providing the correct files so you’re able to lenders, you can buy recognized getting an unsecured loan even after a moderate 700 credit score. Otherwise urgent, another type of good option would be to try boosting your credit score ahead of making an application for the loan. A higher rating a lot more than 750 produces lenders well informed you tend to repay sensibly. This becomes your acknowledged more quickly having lower rates. Of a lot NBFCs like Muthoot Fund provide unsecured loans from the reasonable prices, according to their borrowing reputation. With a media credit history and you can proof to pay-off easily, getting the consumer loan you would like becomes much easier.