Just how long must you live in an excellent va loan house just before promoting

you are unlikley to not getting ugly to the new home if you don’t set a lot of $ off. To purchase for the a unique developement, people do not pay a high price having property once they is also buy one to exactly how they want for the same speed. The creator can also render concessions to buyers you simply can’t (high priced enhancements, investment purchases, etc) And, by the point you cause for realtor charges and concession to help you sell (suppose near to ten% total, you happen to be capable sell for what you owe correct today, but most likely on condition that you add many $ off. Simply an agent will reveal what your domestic can logically get and just what fees/etcetera often likley work at. You must weigh you to definitely resistant to the money you borrowed.

What is no longer working to you personally, and can it is handled in place of selling the home. Dining the newest real estate professional costs and you will settlement costs to market next purchase again is a huge spend of money.

Now on the all of our 8,000 borrowing from the bank

I also live in a hot advancement. however someone want new and will pay it off. I’ve had brand-new house sell, however, in the an effective losings immediately after fees, an such like.

Realtors costs usually takes a huge amount away, in addition to discover individuals who will need new carpeting replaced, yadda yadda yadda.

Thank you for all of the recommendations. https://paydayloanalabama.com/stockton/ We confronted with agent and you may she did a market investigation. Most neat report. Because builder features raised rates and you may centered on what’s offering she necessary an amount that is nearly 20,000 over that which we repaid! Incorporate Va investment fee so you can mortgage in addition to percentage we don’t create certainly not that is okay. There’s several thousand on the price tag getting deals. We are to get a different household in the same builder and making use of a comparable representatives. So they slice the commision for us or even this might not occurs. And creator will be reasonable with a great deal enhance and you may most room from the bundle at no cost.

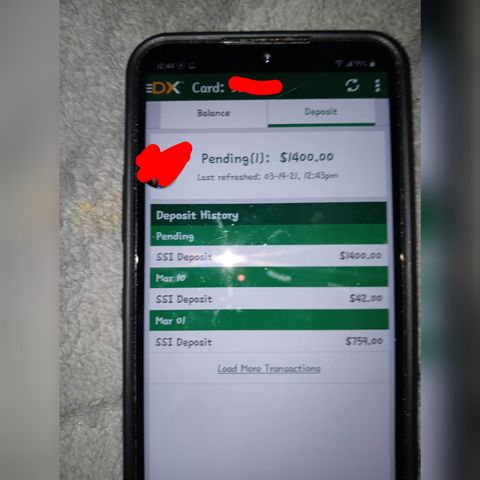

On credit function and you may guidance We achieved up to now if the i sell in 2010 and we dont gain some thing into the it we have to save the fresh new 8,000. We did not perform ammended. We had been waiting to placed on the 2009 fees.

wrote:Make sure to keeps an accountant or anyone in the Irs look at your info to you. I understand to your first system, you’d to remain in our home. For many who offered they within this a particular day, you’d to settle it. Which was the new 7500 borrowing from the bank though. I may be incorrect, however, We wold be blown away if there’s maybe not a clause throughout the remaining in your house for a few years no less than (however, there might never be). In addition to, make sure that whenever you are talking about « gaining » with the family, just what Irs takes into account gains. I do not know if Irs goes on the new sale rates or perhaps the cash you recieve. I have heard it will be the speed the house costs, maybe not the fresh marketing rate minus profits and you will costs inside it. In this case, you happen to be « gaining » on purchases it seems. Once more, I really don’t understand way to such inquiries, just be sure you are having a specialist (and never people in so it deal) reply to your questions clearly.

I was thinking you could potentially just score step one Va mortgage in your existence (that’s what my personal -ex lover air push- dad said), but one thing I have seen on the pay attention to can get oppose you to definitely

I’m sure you have to stay in our house getting 3 years or pay-off the newest $8000. I needless to say go along with mickie that you ought to look into that.