Advantages of a beneficial Pursue Family Equity Credit line

Open the chance of their house’s collateral having Chase HELOC cost. Mention flexible credit choice, advantages, and you can important aspects affecting your rates today.

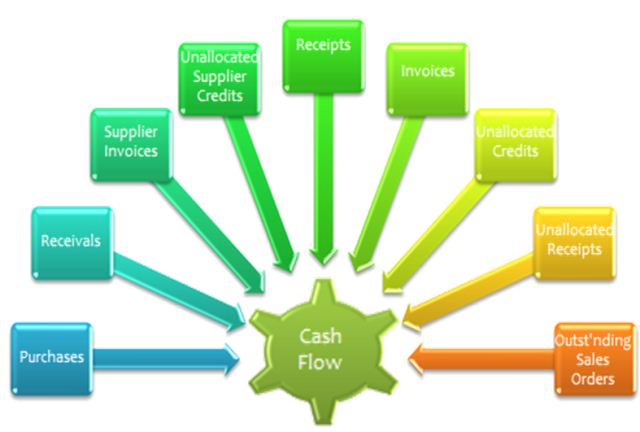

When it comes to ways to finance a significant expenses, a house Equity Personal line of credit (HELOC) are a great alternative. Knowing the Chase guarantee credit line cost is very important for some body considering tapping into the residence’s equity.

At all, your home is not simply a place to real time; additionally, it is an asset that will help reach your monetary requirements. On this page, let’s simply take an intense diving into what Chase offers out of HELOC cost, how they compare to other lenders, and you will things to remember because you browse it economic device.

Expertise Home Equity Personal line of credit

A home Equity Personal line of credit, otherwise HELOC, was a good revolving line of credit which allows that acquire from the guarantee you manufactured in your property. Consider it due to the fact a charge card in which your house provides since equity.

You can use, repay it, and you can borrow again, the same as how you explore a charge card. It freedom is one of the main draws out-of good HELOC.

When you consider making an application for an excellent HELOC at Pursue or any other financial, it is crucial to learn both the professionals and you will threats in it.

The advantages is straight down rates of interest compared to old-fashioned financing, the ability to accessibility a large amount of money, and you will possible taxation deductibility to the attract.

not, with your masters been threats, particularly variable rates and must safer their mortgage facing your property.

Chase’s Aggressive Prices

Chase is known for being competitive in various financial products, plus HELOCs. Its prices often echo economy manner, that may change because of economic climates.

When contrasting Chase collateral personal line of credit pricing, it is possible to notice that they typically promote costs considering your creditworthiness, the degree of security in your home, plus the overall financial ecosystem.

Essentially, the latest loan’s rates is actually variable; it means they could change-over date. Reckoning these differences to your financial planning is key, so that you know how much you might be investing monthly.

Prior to deciding, it is usually best if you evaluate their pricing up against most other associations so you’re able to verify you’re making an educated financial choice for your self.

Items Affecting Pursue HELOC Cost

Numerous circumstances can be determine this new cost you’ll receive to possess an effective Chase HELOC. Because financial sets base costs, your personal financial situation takes on a vital role inside choosing the latest last rates. The following is a run down of one’s key elements that connect with your own rates:

Credit score

Your credit rating the most tall facts loan providers believe whenever choosing the pace to suit your HELOC. Fundamentally, a top credit rating ways straight down risk, that may enable you to get a very positive rates. Chase typically also provides most useful prices for these with score significantly more than 700, while individuals with down score will find by themselves up against highest prices.

Loan-to-Worthy of Ratio

A separate crucial basis is the mortgage-to-worthy of (LTV) proportion, and this compares your mortgage balance to the appraised worth of your property. A lower LTV ratio will make you qualified to receive best prices.

In order to determine your LTV, just divide their the mortgage harmony by your house’s appraised worth. Essentially, keeping your LTV less than 80% can also be somewhat work with your debts at Pursue.

Form of HELOC

Chase offers different kinds of HELOC issues, each having its costs and terms. You might find combos from repaired and you can adjustable installment loans online Illinois prices, otherwise entirely adjustable-rates selection, which permit you to select an item you to most closely fits your means.