payday cash advance loans near me

Enhanced Agent Site that makes your work much easier

Is it possible you feel overloaded by the subscribers researching ways to do their debts? Did you know 77% of Western home are speaking about some kind of financial obligation? Credit cards, personal loans, necessary family solutions, college bills, medical repayments the list of obligations are limitless. American houses bring $ trillion in debt by Q2 2024, averaging $104,215 per household. Since personal debt-ridden facts appears like a nightmare, a beneficial lifeline does can be found. Debt consolidating and money-away refinancing are a couple of powerful tips which can significantly boost an excellent debtor’s financial predicament. These are a means to clear up complex debt preparations, all the way down interest rates, and you can potentially access most fund.

It is critical to understand that it perform in a different way and suit other financial affairs. So, due to the fact a mortgage broker, it’s your task to grasp the nuances out-of debt consolidating and you may cash-aside refinancing to be able to render your potential customers with professional advice to assist them pick the best obligations management service.

- Most of the operations at your fingertips

- Easy-to-fool around with easy to use software

- Included AI tech

A&D Financial try purchased that provides just exceptional service and you will tailored choices also helpful suggestions. That’s why our company is right here so you can get the full story regarding debt consolidating and cash-away refinancing and just how they can benefit customers.

impossible Wisconsin installment loans no credit check

What is Debt consolidation reduction?

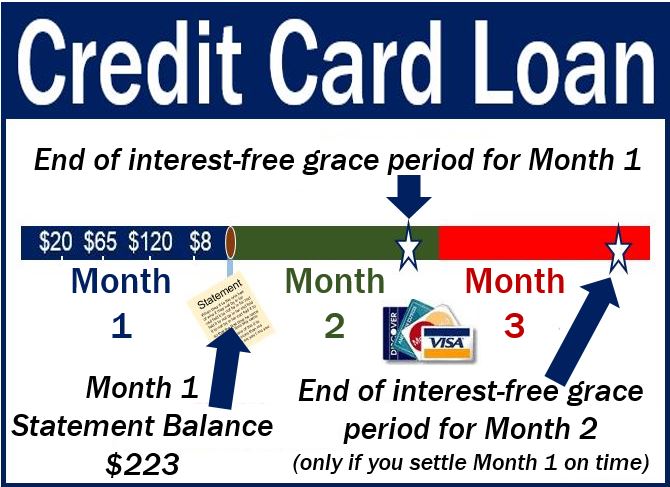

Many people e time. Unsecured loans, credit cards, college loans it may be too much to juggle with assorted payment dates and you can rates. That is where debt consolidation will come in. It is instance consolidating all their bills towards the one, under control mortgage. In lieu of and work out multiple costs monthly, they only get one. The key benefit of this strategy are convenience for the readers. It allows them to manage the personal debt, making it simpler to handle of the emphasizing just one monthly percentage.

What is more, new mortgage often includes a lower life expectancy interest than just a debtor is expenses ahead of, that could result in expenses far less within the appeal money more than the life of financing. Plus, combining bills can help your potential customers boost their fico scores, which makes it easier to get financing afterwards.

It is vital to note that, believe it or not, debt consolidation is not only having personal credit card debt. It may be a solution for various debts, including scientific expenses, college loans, as well as house security money. At exactly the same time, particular could possibly get mistake debt consolidating having dollars-aside refinancing. Whenever you are each other are a good idea inside the handling personal debt, these include line of tips. Debt consolidation reduction generally speaking comes to taking right out a separate financing, commonly unsecured, to settle established loans. In contrast, cash-out refinancing changes a current mortgage with a much bigger one to, allowing a borrower to gain access to more money. Once the home financing professional, you will have a definite image of bucks-out refinancing against. debt consolidation, which we shall explore in more detail further.

What’s Dollars-Aside Refinancing?

Cash-away refinancing was a strategy which enables home owners to view the security they will have built up within assets. New mechanics is actually fairly simple. Individuals change their most recent financial with a brand new one that is larger and you will get the difference in dollars. It dollars can then be used for many different intentions, and debt consolidation reduction, and make home improvements, financial investments, or any other costs. This strategy is going to be beneficial because have a tendency to offers a lowered interest rate as compared to other forms from debt. Therefore, probably one of the most popular ways to use bucks-away refinancing is to consolidate highest-desire personal debt. From the combining multiple bills to the just one, lower-interest mortgage, homeowners could easily spend less on notice repayments and clarify the economic lifestyle. This is an easy method out, particularly for the individuals not able to match multiple monthly installments.

Example

Let’s need a prospective situation including. Imagine the client has $70,000 for the high-appeal bank card and private mortgage debt. They own an effective $eight hundred,000 home and owe $250,000 on the financial. If they utilize the cash-aside choice, they may be able re-finance its financial getting $320,000. Like that, the newest mortgage pays from the new $250,000 financial and certainly will feel the left $70,000, which the client get due to the fact cash. Capable utilize this dollars to repay their highest-attract personal credit card debt and consolidate it into a single home loan fee having a lower life expectancy interest.