how much is interest on a cash advance

RBI Price Hike: This is how Your residence Mortgage EMIs Are prepared To rise

The pace walk has a tendency to connect with those who have taken mortgage brokers since their EMIs are set to rise

The fresh new Set-aside Financial regarding India (RBI) announced a good 35-base section (bps) hike on repo price to help you six.twenty five percent into Wednesday. This is basically the fifth straight walk by the central lender and you may does apply at anyone who has removed mortgage brokers since its EMIs are typical set to rise.

Brand new Repo rates is the rate where banking companies acquire away from brand new RBI. It indicates banks would need to spend more money towards the RBI, and usually, banks pass on the purchase price to help you individuals of the expanding their loan interest rates.

RBI provides hiked the new repo speed of the 190 bps regarding earlier around three regulations. The initial hike would be to this new song out-of 40 basis things in-may and followed it that have 50 basis factors when you look at the Summer. They once more raised the repo rate by the 50 foundation points during the August and again because of the 50 foundation items into the Sep. Considering the current walk regarding thirty-five foundation circumstances, the total go up comes out in order to 225 base issues.

Mortgage rates of interest have surged to eight.5 percent away from 6.5 per cent in-may. Following the fifth rate hike on Wednesday, the fresh new credit pricing is determined to increase for all those.

Advertising

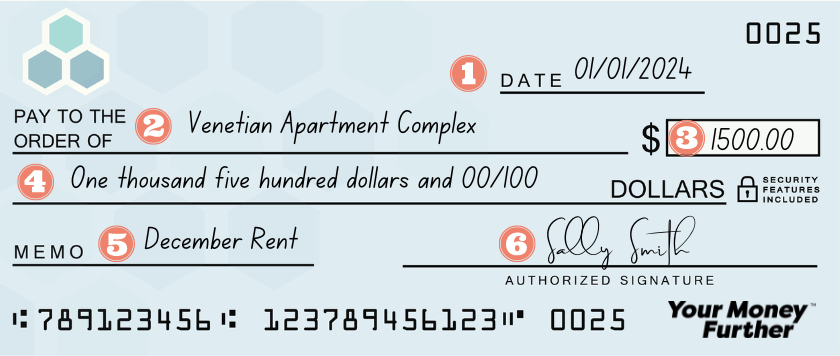

Eg, if the a debtor has brought home financing from Rs 20 lakh with the a great 20-season several months for a price of interest from 8.50 percent.

Right now, he’d feel paying Rs 17,356 given that EMI. However with 0.35 per cent boost adopting the repo speed walk, the brand new interest rate perform plunge to 8.85 %, using the EMI add up to Rs 17,802.

The total appeal count before the hike is Rs 21,65,551 but following the price hike, the complete notice count might be Rs twenty two,72,486.

Before last financial plan meeting to your September 31, the RBI got already raised the repo price from the 190 bps out-of 4 % so you’re able to 5.9 % inside a brief period of five weeks.

Just after RBI’s fifty basis issues speed hike in the Sep, multiple banking institutions and non-banking casing finance companies improved their home financing prices.

New affect your home https://paydayloansconnecticut.com/kensington/ financing EMI commonly mainly rely on the remaining period of your financing. The greater the rest tenure, the higher may be the payment upsurge in your EMI.

Finance companies usually to evolve the latest dive inside interest rate by stretching the fresh new EMI period so the EMI amount remains intact into the borrower.

Banking institutions or other loan providers usually keep a get older limit (constantly sixty-65 age) towards the borrower till that they allow the tenure extension. If your period expansion exceeds that, loan providers do not continue the new tenure subsequent.

Advertisement

Hence, loan providers might not have a choice of raising the tenure to own of several borrowers and they’re going to sooner add more month-to-month EMIs after that repo price hike.

However, more youthful individuals with smaller financial tenures will most likely not deal with which compulsion because lenders can still possess some support to improve its period.

Adopting the speed walk during the September, of numerous banks and SBI, PNB, ICICI Financial, Bank from Baroda, etcetera. hiked their loan interest levels.

ICICI Lender launched a fifty-bps increase in their additional active September 31. SBI enhanced their outside benchmark credit rates (EBLR) and you will repo-linked financing speed (RLLR) by the 50 base factors (bps).

Advertisement

Punjab National Financial (PNB) increased the fresh new repo-connected financing rates because of the fifty basis things, increasing it from seven.70 % to eight.forty percent.