How often Usually a mortgage lender Eliminate My Borrowing?

Have you wondered, how often have a tendency to a lending company pull my personal borrowing from the bank? The answer differs from personal references, but here’s what you might fundamentally predict.

- A primary credit inquiry when you look at the pre-acceptance techniques.

- One minute eliminate are not as likely, but can periodically exists as mortgage has been processed.

- A middle-techniques remove or no inaccuracies are observed in the report.

- A final monitoring report could be pulled regarding the credit reporting agencies however, if the newest financial obligation could have been incurred.

Couple homebuyers have the cash in hand to order property downright, so they really manage a mortgage lender in order to safe financing. Although not, just before a lender agrees to allow an optimistic homebuyer acquire probably hundreds of thousands of dollars, they first have to evaluate exactly how ready and you can in a position the brand new borrower would be to pay the borrowed funds.

When you get a mortgage, financing officer discusses your credit score and rating in order to assess the manner in which you has actually addressed financial obligation in past times. The better your credit score, the greater amount of happy loan providers should be promote mortgage loans to your best conditions and lower rates of interest.

However, you’ve got read that lenders remove your credit report many times from inside the home loan application techniques, that can bring about your credit score to decrease. Even though this are theoretically true, there is so much more with the facts.

Mellow Credit Inquiry

This type of credit check is commonly conducted by home financing agent so you’re able to prequalify audience payday loans online North Dakota in advance of sending these to a lender.

Delicate questions simply promote body-level facts, including projected credit rating, address confirmation, open lines of credit, and you will flags no info. Softer borrowing from the bank questions do not require the permission, do not connect with your credit rating, and are not noticeable on the credit file.

Tough Borrowing Inquiry

This type of borrowing from the bank inquiry assesses a beneficial borrower’s risk level ahead of a loan provider will provide a home loan, auto loan, student loan, otherwise bank card.

Hard inquiries diving to the information on your credit score, as well as your newest credit rating, current borrowing from the bank questions, overlooked costs, bankruptcies, foreclosures, and other guidance strongly related to your creditworthiness.

Lenders you need your own consent to get their full credit history, and you can performing this may cause your credit score to drop slightly, however, merely temporarily.

When to Assume Credit Draws During the Mortgage Software Process

How many moments your credit history was pulled about home-to shop for techniques relies on multiple items, also just how long it will require so you can accomplish the brand new product sales, if there are inconsistencies between the application therefore the credit history, and you may whether any warning flags pop up ahead of closing.

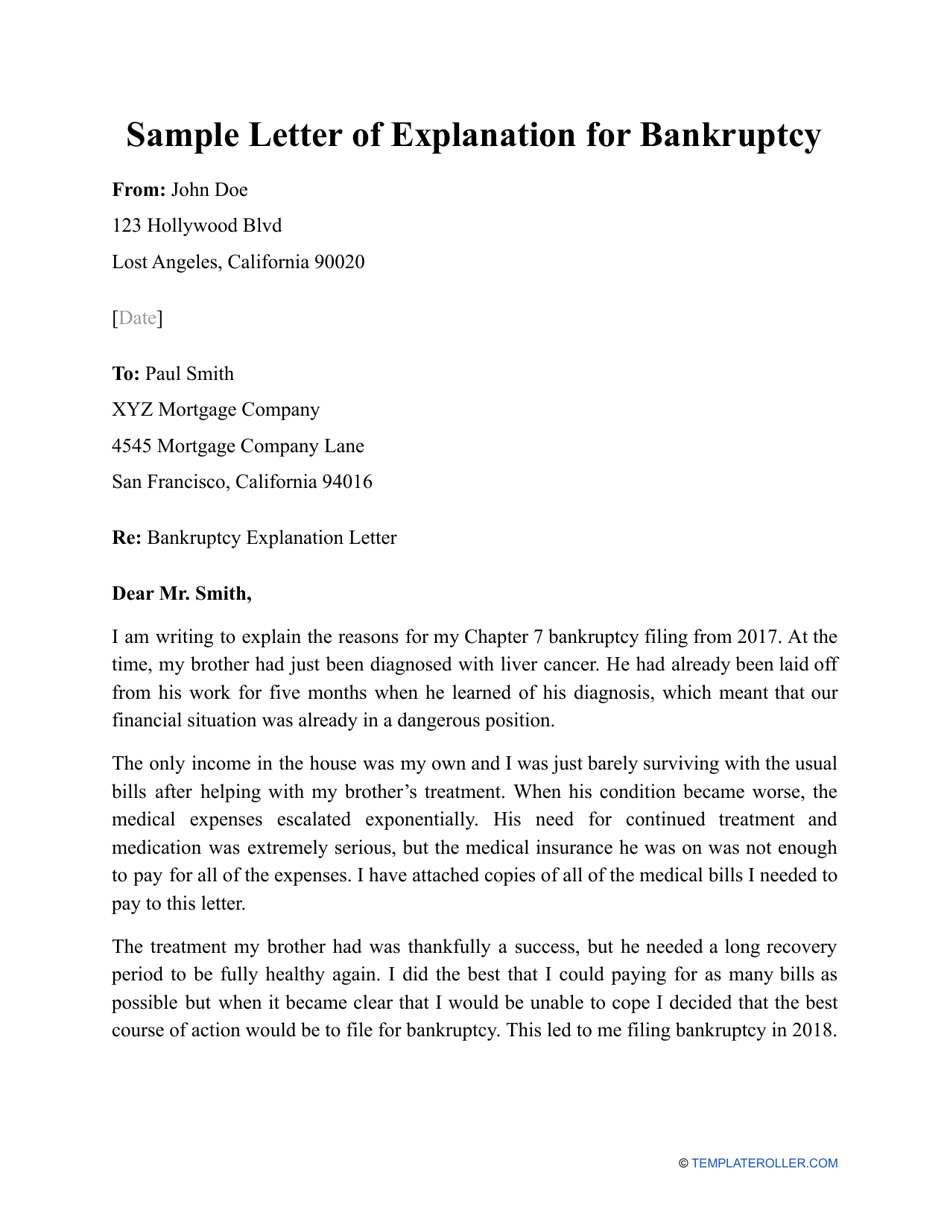

Throughout the pre-approval, that loan manager brings and you can evaluates your credit history, deciding on commission record, personal debt load, foreclosure or bankruptcies, liens, civil provides, and you may judgments. That it 1st borrowing query are basic for all home loan programs.

Sometimes, the lending company should pull your credit report once again while the loan is actually processed. Credit reports are only valid to possess 120 weeks, so your financial will need another backup in the event the closure drops additional that window.

The lending company may eliminate borrowing from the bank middle-processes if they pick discrepancies involving the study into the statement along with your newest pointers. This may involve a reputation change, the fresh address, otherwise low-complimentary personal safeguards amounts.

Normally, your own bank don’t have to re-pull a credit history prior to closing. When your mortgage initiate control, a loans-reporting monitor was caused. This may alert your own financial in the event the other people draws the credit just like the mortgage is finalized.

In advance of closure, the lender commonly remove a final keeping track of report regarding the borrowing from the bank bureaus to determine if or not your obtain people new financial obligation. People the new levels have to be put in the debt-to-income proportion, probably affecting the original financing conditions or even inducing the financing are refused.

Exactly how Borrowing Checks Feeling Your credit score

Too many credit inquiries inside a short span is also briefly straight down your credit rating. not, you actually have the right to look around for a mortgage.

Credit statistics providers such as for instance FICO and you can VantageScore bring consumers an effective shopping screen, so you’re able to shop around to discover the best terms and cost with assorted lenders with no your credit rating dinged multiple times.

Particularly, whether your credit was pulled by the around three lenders within two weeks, the credit will not be impacted 3 times. Since the all the around three draws originated in financial businesses, they amount as the an individual pull.

Yet not, should your borrowing from the bank try taken by the loan providers regarding a few more markets within 120 weeks-such as for example, a dealership and you can a home loan team-your credit score you will definitely get rid of somewhat.

In case your the fresh mortgage looks in your credit history, their get will lose several affairs. However,, as long as you make complete, on-date money, it does return up. Actually, when treated properly, home financing is among the best ways to make solid borrowing from the bank ultimately.

While in Question, Ask a professional Mortgage Administrator

Given that you’ve see, there is absolutely no solitary solution to the question, how frequently usually a lending company pull my personal credit?

Integrating with that loan administrator makes it possible to navigate the new twists and transforms of the home-to buy procedure, including simple tips to overcome the new perception out-of borrowing from the bank checks on the credit score.

Ask your loan administrator to review your own borrowing from the bank pull and you will by hand assess your computer data in order to guess their credit possible before performing a hard remove for a good pre-degree or pre-acceptance. It will help determine whether you can be eligible for a mortgage in the place of lowering your credit rating.

Whether your credit score try below finest, talk to a loan Officer in the distance financial category about selection in order to old-fashioned mortgage brokers, instance Government Construction Expert (FHA), Experts Things (VA), and you may You Agency out of Agriculture (USDA) funds.

Even for significantly more household-purchasing hacks, download eleven Extremely important Domestic-Purchasing Resources from Actual Home mortgage Officers . Rating expert advice into the anything from finding your way through homeownership to getting just the right information with the closure desk.